Idaho and the Inland Northwest’s Premier Business and Litigation Law Firm

Comprehensive Expertise with a Customized Approach

Built on Trust. Backed by Experience.

With a deep pool of knowledge, a commitment to integrity, and a relentless spirit, we’ve been helping businesses put ideas into action since 1964.

Hawley Troxell and Team from Moss Immigration Law Join Forces

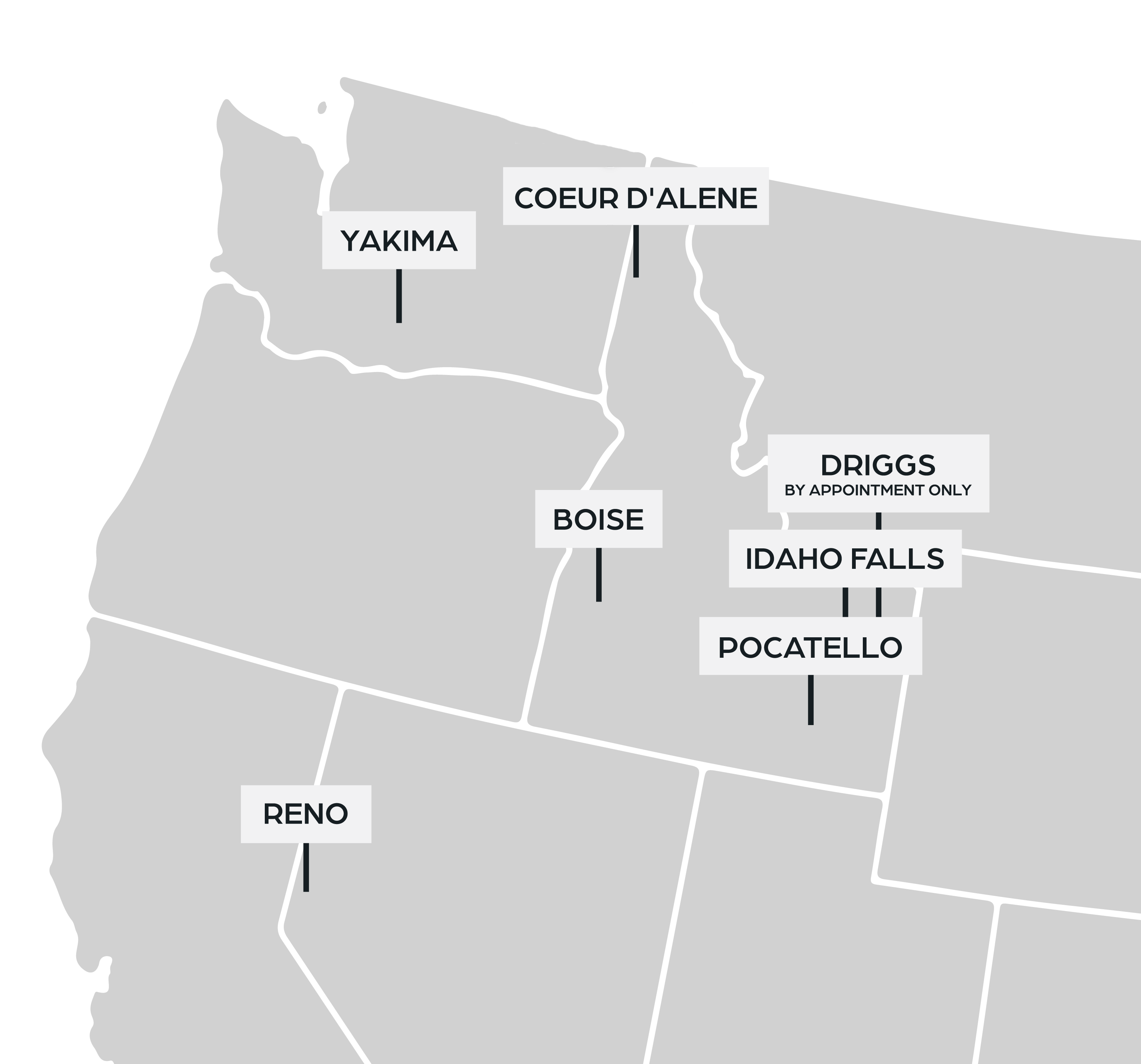

Hawley Troxell and Alycia Moss of Moss Immigration are coming together to enhance and expand services for clients throughout Idaho and the Inland Northwest. Hawley Troxell will add an Immigration practice area and expand operations in Boise, Coeur d’Alene, Idaho Falls, Pocatello, Reno, and Yakima.

Our Podcast: Attorney Time

Covering topics from current legal news to advice for founders, Attorney Time brings Hawley Troxell’s business law expertise to the public.

Building Successful Strategies Together

We rely on years of combined experience across many areas of specialization to bring our clients dependable, applicable, and effective counsel.

Our Locations

Hawley Troxell serves clients nationally and internationally from seven office locations across Idaho and the Inland Northwestern United States. Learn more about our attorneys and their specialty areas in each of our locations below.

What can we do for you?

Learn more about how our team can help you reach your business goals. Send us a message below or give us a call at 208.344.6000.

"*" indicates required fields